Intro

This is the third and final instalment in the series, on how to trade Eurozone Bonds in a multi strategy approach. Now a quick recap (see links to prior articles above):

Merger Arbitrage - A strategy which profits from a country’s bond yield typically lowering when they join the Euro, relative to an anchor yield (e.g. Germany)

Shadow Banking (Carry) - A strategy which profits from the spread between the lower and higher yielding countries within the Eurozone (e.g. Borrowing from Germany and lending to Greece)

Now we discovered with both strategies, they both tend to do poorly during large macro events (e.g. 2008 GFC, 2010’s Eurozone Crisis, 2022’s rapid rate hiking). So how can we protect ourselves, during such times?

Strategy 3: Trend

What tends to happening during major events in the Eurozone is the following:

People run for safety > buying what is deemed the safest government bonds (e.g. Germany) > either selling or not buying as much of the riskier bonds (e.g. Italy)

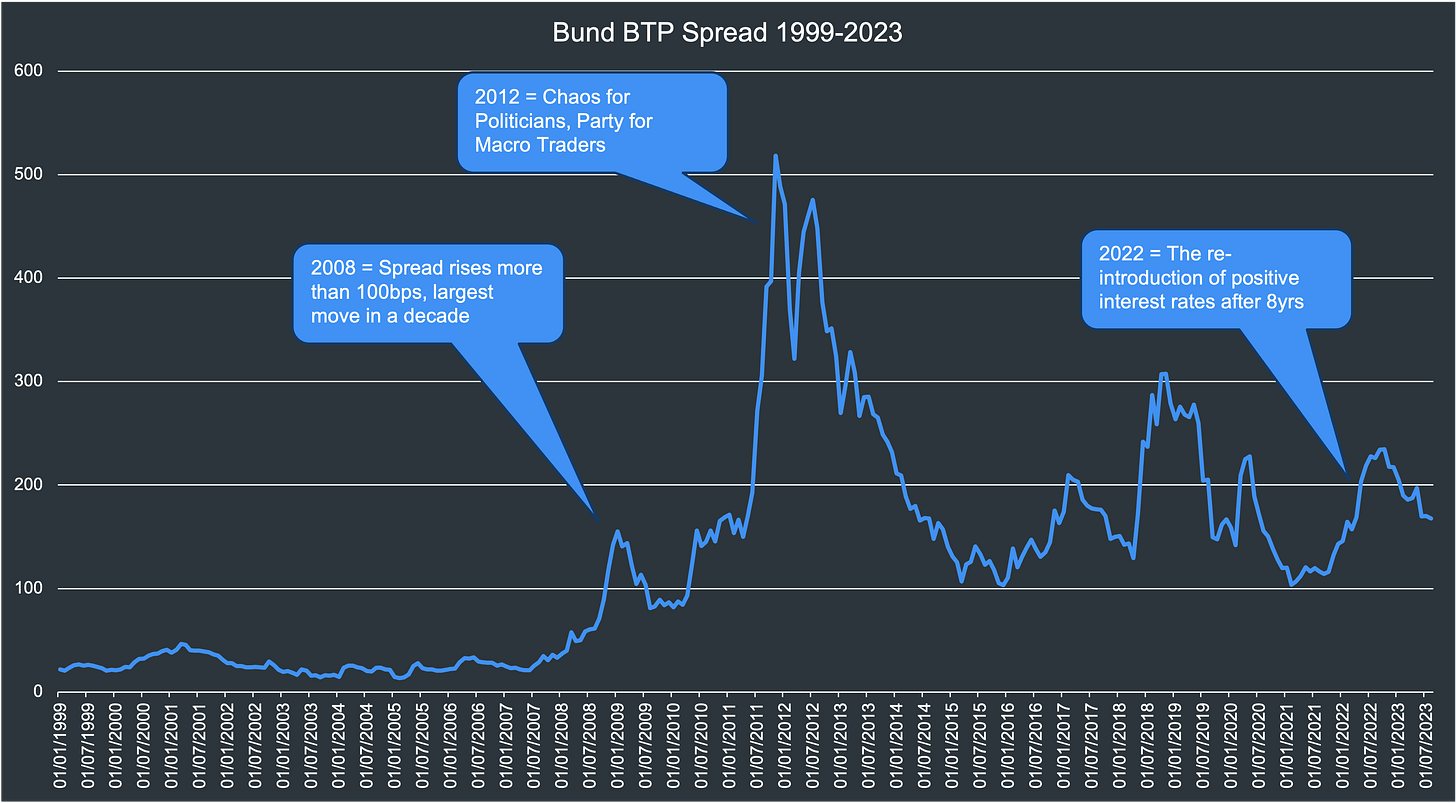

To illustrate my point, take a look at the spread between Germany and Italy (aka Bund-BTP spread) since the inception of the Euro. As you can see during all aforementioned crisis’s it tends to widen, then comes back down.

So we’re going to deploy a simple strategy that trades the trend, attempting to make profits when the spread rises and when it falls (because typically these moves are a several month protracted affair). In movie terms, like Jason Statham in Crank pictured above, we don’t care what causes a trend (or in his case adrenaline), we just need one to make money (or in his case stay alive). Sideways markets are the devil, volatility is the angel (unlike our previous Shadow Banking/Carry strategy, which desires the complete opposite).

Methodology:

Same data from the previous articles which is from the OECD (main source) and ECB (x3 which OECD didn’t have).

Calculate the monthly yield spread between German and Italian 10 year bonds

When the spread is greater than the prior 12 month moving average spread, we go long Germany/short Italy (betting on chaos) and if below the moving average the opposite (betting on things calming down). We review the position monthly, meaning sometimes it will change direction and other months we continue with the same positions.

Performance

Unlike our previous Shadow Banking Trade (see previous article), this thing never got cremated which is nice (2012 Greece default) and the return profile was different. It did 7/10 positive years rather than 8/10, including 2 periods of B2B negative yearly returns. This is part of the reason why you don’t see Trend strategies in a lot of portfolios, because it doesn’t always consistently fire and very few people have the patience to watch a strategy lose money for 700+ days and stay invested.

Though the important part, is what does it add when combined with our existing strategies?

All 3 Strategies Combined

Edge = (% positive years * average winning year PnL) - (% negative years * average losing year PnL)First of all, do all strategies make money? Yes. My go to statistic for seeing if I have a profitable approach, is Richard Dennis’ edge calc which I’ve adapted here (see this book). If it’s positive, then this suggests we have a consistent way to make money, if it’s negative then it’s probably best to refine or scrap it.

Secondly, does it protect us from the macro events mentioned earlier/negative years for our other strategies? Yes.

As you can see, in 7/8 occasions when we had losses in the other strategies, Trend didn’t (in practice, you’d want Trend to have several times the risk allocation/leverage compared to the others to consistently cover the losses). So onto the now famous part.

Note: As mentioned in the prior article, 2012 would have blown up the Carry strategy as Greece defaulted. Though I would have hoped in practice you’d have used a stop loss and lent money to several countries, not just one.

Recommendations to Investors

Think Multi Strategy

This series wasn’t designed to show how to pay for your next Lamborghini or McLaren (that’s coming next year), because to do that I’d need more accurate data to account for bid/offers, cost of carry (thank you Hamish) and other things.

This series was designed to show that even within a very narrow set of assets such as Eurozone government bonds, you can still get creative and achieve diversification by deploying simple systematic trading strategies. Personally I’d still Buy and Hold government bonds, then add these over the top as an extra kicker since they’re all relative value (meaning they fund themselves essentially).

There’s tons of others you could deploy (e.g. Curve Shape, CB Reaction Function, Mean Reversion etc), though like most good film series I’m going to leave this as a trilogy. I know in most aspects of life, the advice is to stick with one discipline/person (e.g. not cheat on your husband or wife), though when it comes to successful investing it really does pay to be diverse and multi strategy.

Hope you enjoyed this short series and wishing you a great 2024

Chris