Intro

Most investors allocating to European Government Bonds will buy and hold them. It works, nothing wrong with it. However sometimes it is worth exploring different ways to trade things. So just like all good scripts which had too much content to fit into one film, I’m going to do a short series on how to trade European Government Bonds in creative ways, then summarise how they fit together in a multi strategy approach.

Part 1: Merger Arbitrage

For those of you running money in the 1990’s, you may remember the famous EU Convergence Trade (or as I like to call it, a macro merger arbitrage). It was quite simple logic really:

Government Policy Converges > Trade Policy Converges > Central Banking Policy Converges > Government Bond Yields should too

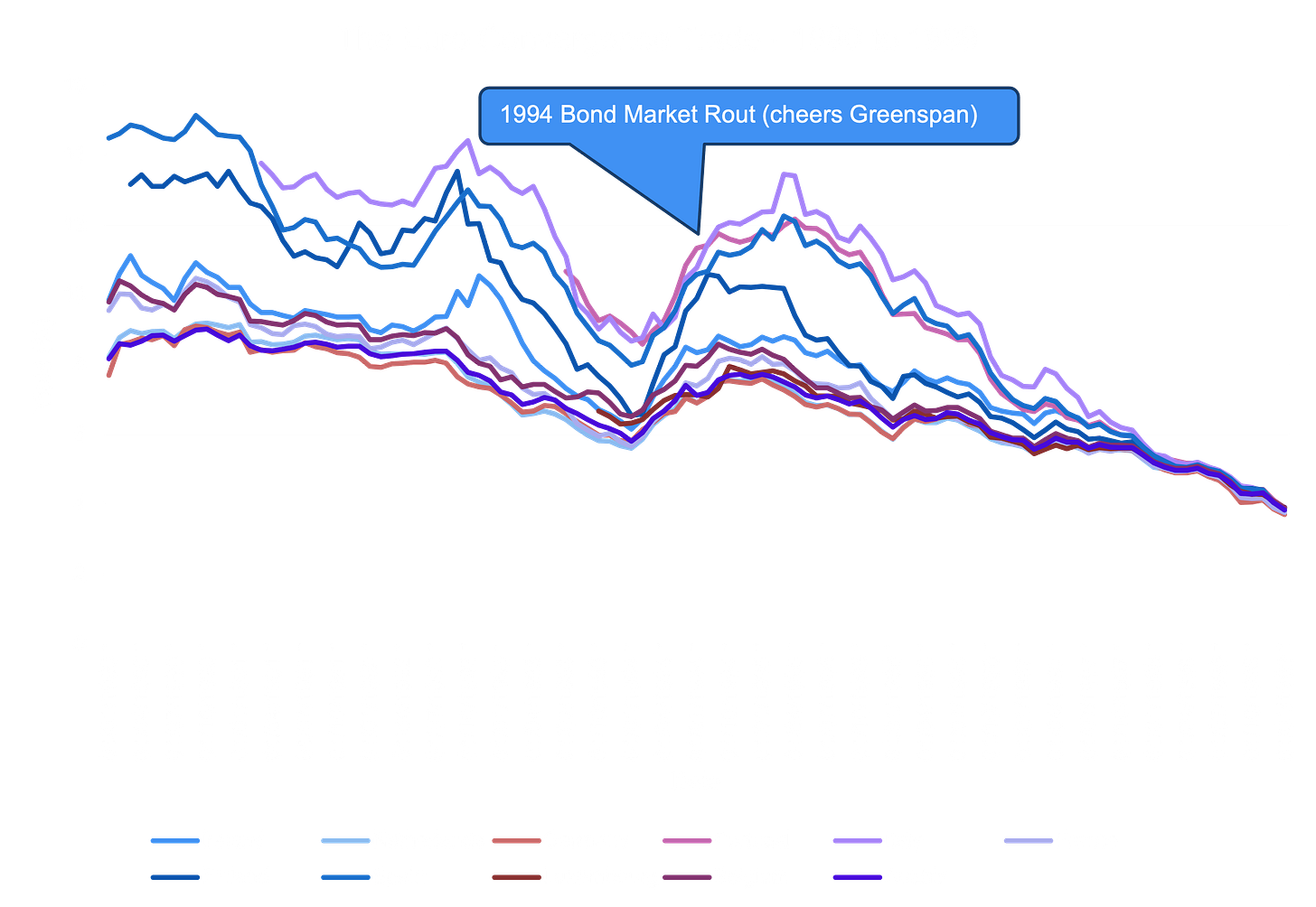

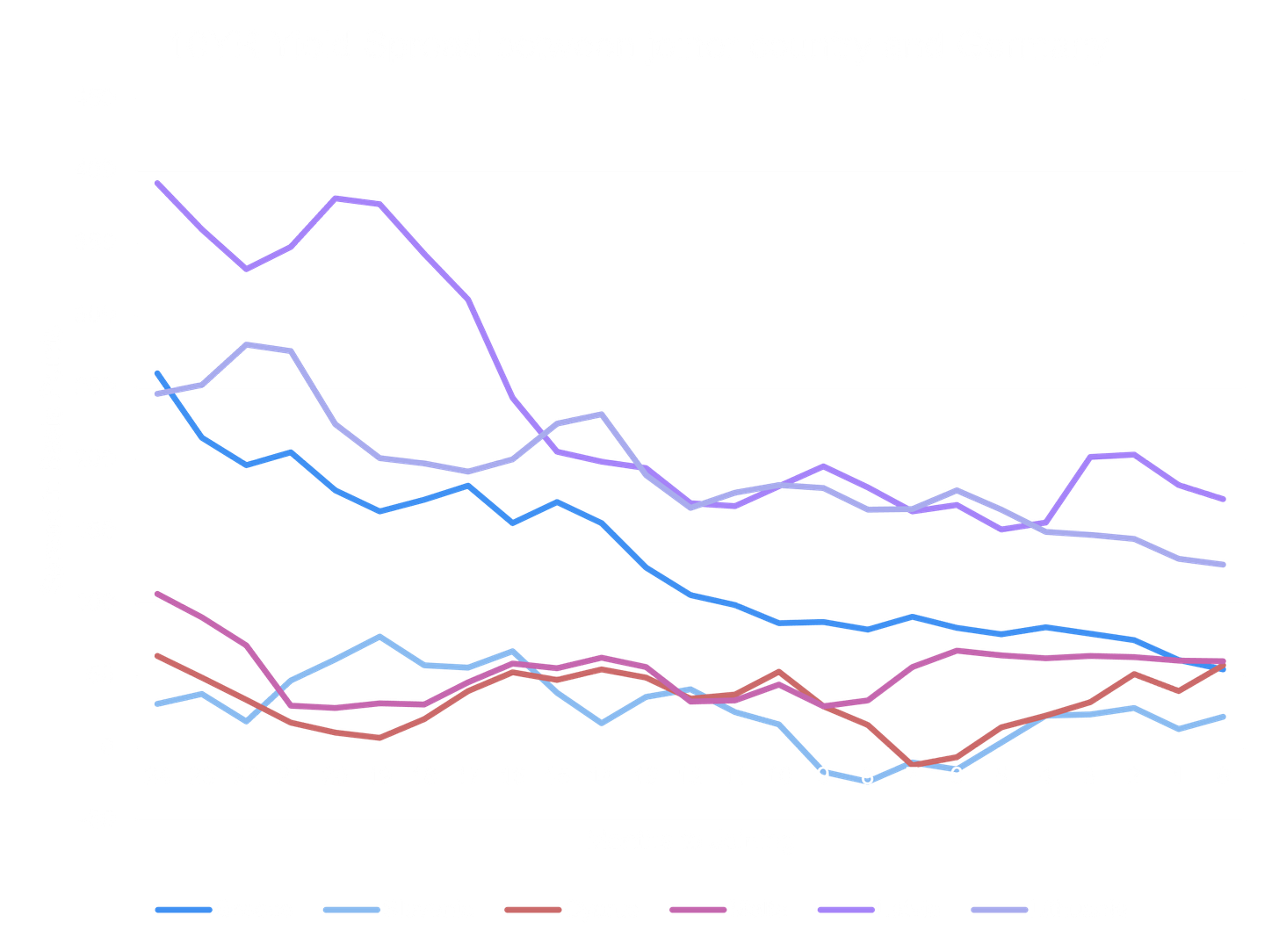

Here’s a visual look at what happened - basically all countries joining the Euro went from having largely different 10 year government bond yields, to having the same.

To put it another way, if you’re Karen Hill in Goodfellas (Spain on this chart) and marry Henry Hill (Germany on the chart), chances are lenders will be happy to charge you less, because you now have the implicit backing of someone much stronger (he is part of the mob after all). And that is basically the Euro in a nutshell, with Christine Lagarde currently heading up “The Firm”.

Now it’s easy to assume like marriage this was a “one off event” (because of course nobody gets divorced these days) and thus little value in studying it, because you can’t make money from it again. Though since the 11 original Euro countries, there’s been 9 more members joining/merging into this mob. So as per normal inspiration for my articles, woke up around midnight and thought “wonder if you can systematically trade Euro Convergences?”. So let’s find out.

Methodology

Get 10 year government bond yield data from the OECD (main source) and ECB (x3 which OECD didn’t have, I couldn’t source data for Estonia so feel free to donate to my Bloomberg Terminal crowdfund)

Focus/isolate the data from 2yrs prior to the official joining date for each country. See Note 1 for arbitrary choice of 2yrs

Calculate the yield spread/difference between the country joining and an anchor yield (unsurprisingly chose German 10 Year) over that 2 year period, on a monthly basis

Make some observations and investor recommendations as per usual

Note 1: I chose 2 years because you normally know at least this far in advance that the country is joining (e.g. Slovenia and others you had 2 and half years notice).

Results

Below is a table showing the decline/increase in the spread (green/red respectively) from 2 years prior to joining the Euro, compared to the yield spread on the joining date. For example:

Jan 1st 1999 = 260 basis point spread between Greece and German bonds

Jan 1st 2001 = 55 basis point spread between Greece and German bonds

260 - 55 = 205 basis point decrease

The ones that converged

As you can see from the table 6/8 (or 75%) of the yields dropped from 2 years out to joining the Euro. You can see visually that the 3 biggest movers (Greece, Latvia, Lithuania) all started with the highest spreads. In other words the greater the prior credit risk, the more the country benefited from joining the EU (akin to a small firm with a bad credit rating being acquired by a global conglomerate, hence my Merger Arbitrage analogy)

The 2 which didn’t converge

So why did Slovakia and Croatia’s yields not converge? Because they both joined the Euro during “bad times”.

Regardless of people being excited for Henry’s Hill’s and Karen’s marriage (yields converging), if a tornado hits the wedding venue (Lehman brothers defaulting) all hell is going to break loose. Thus it is understandable that when the macro environment is bad (akin to a merger deal looking like it will fall through), the spread widens:

Slovakia 2007-2009, during a large economic collapse

Croatia 2021-2023, during the re-emergence of inflation/massive central bank hiking

Recommendation to investors

1. Keep an eye on the next Euro joiner

There’s still 7 members of the EU who haven’t adopted the Euro and there maybe more joiners of the wider EU, so you might want to keep on eye who is likely to join the Euro next. This is probably best expressed through a long/short play (e.g. Short German Bonds, Long the joiner Bond aka Short Acquirer, Long Target) though there’s a lot of different ways you could structure this (e.g. 5 year bonds instead of 10, interest rate swaps, futures, credit default swaps etc). Go wild.

2. Pay attention to the macro backdrop

As shown in the charts above where in 1994, 2008 and 2022 spreads between the joiner countries widened, it cannot be emphasised enough that smart and logical trades can easily go against you during macro blow ups.

It’s obvious though the 1998 LTCM crisis, 2007 Quant Quake and the 2023 SVB collapse, all demonstrated that even the best fund managers in the world continually overlook this fact. I get it, there is limits to human cognitive ability. So if you want a simple way to keep on top of things, I think the Human Piranha’s advice in Liar’s Poker is pretty good, which is:

“If you don’t pay f***in’ attention to the f***n’ two-year, you get your f***in’ face ripped off.”

This is in reference to the US 2 Year Yield, which during all the episodes mentioned above moved violently. So if you want a quick reference point on if the world’s blowing up, it’s not bad.

Conclusion

To implement this might be a bit challenging, especially if you’ve got a tight mandate (e.g. going long/short, potentially hedging the fx though it seems prior to the joining date the country starts issuing Euro denominated bonds). Though I’m sure some macro traders have and continue to make money from these convergences. Appreciate these opportunities only pop up every few years, so my next article will focus on a strategy which brings in more regular profits.

Hope you enjoyed reading this

Chris