Intro

Following on from the Lottery Mathematics article which showed lotteries are highly unlikely to make you rich, I’m now going to talk about Equity Mathematics. We’ll compare 3 different forms of equity investing, and the odds of making money in each (by that, we simply mean a positive return):

Angel Investing = Investing into companies right at their inception

Single Stock Investing = Investing into single companies listed on a stock exchange

Stock Index Investing = Investing into a country stock index, typically comprising of the biggest companies e.g. the S&P 500

Angel Maths

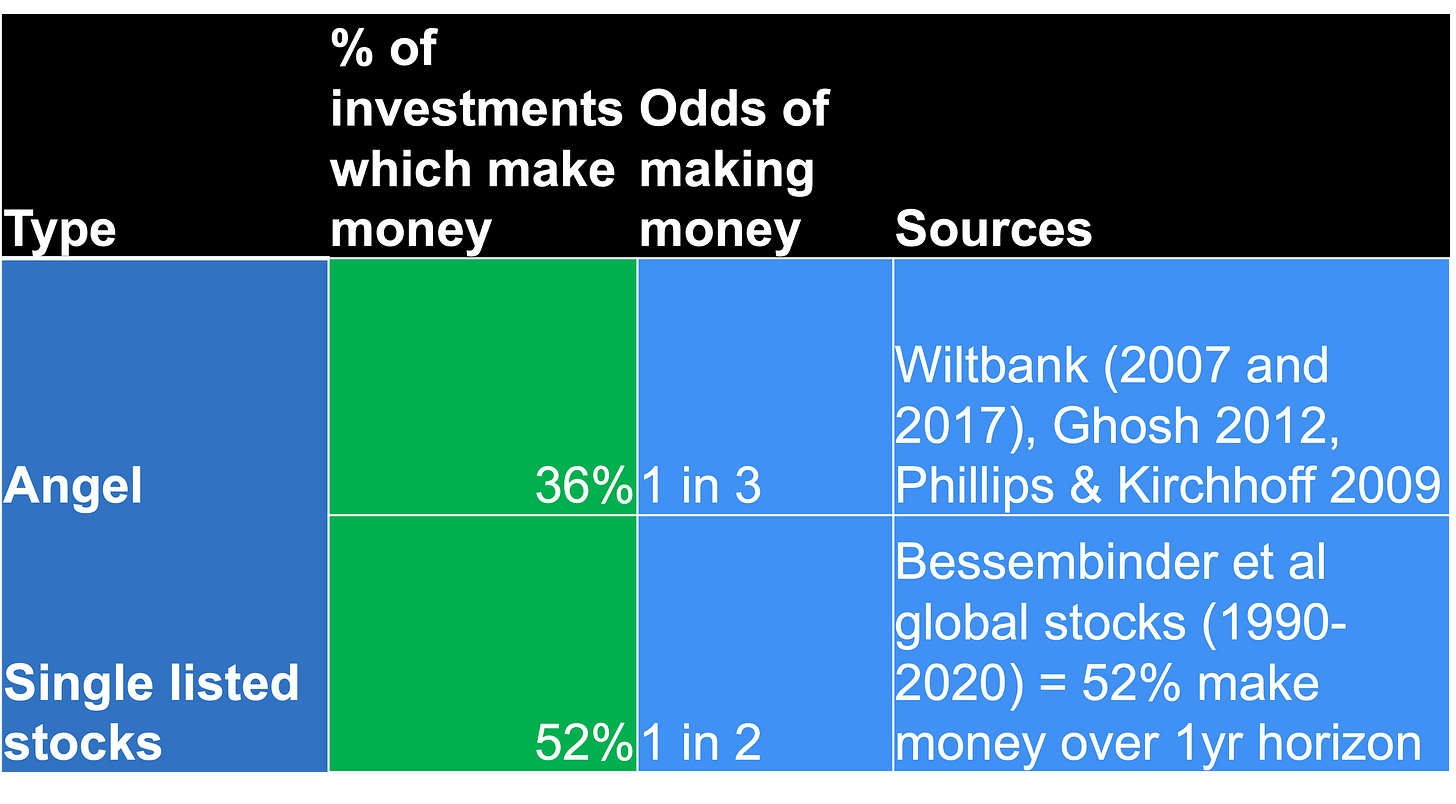

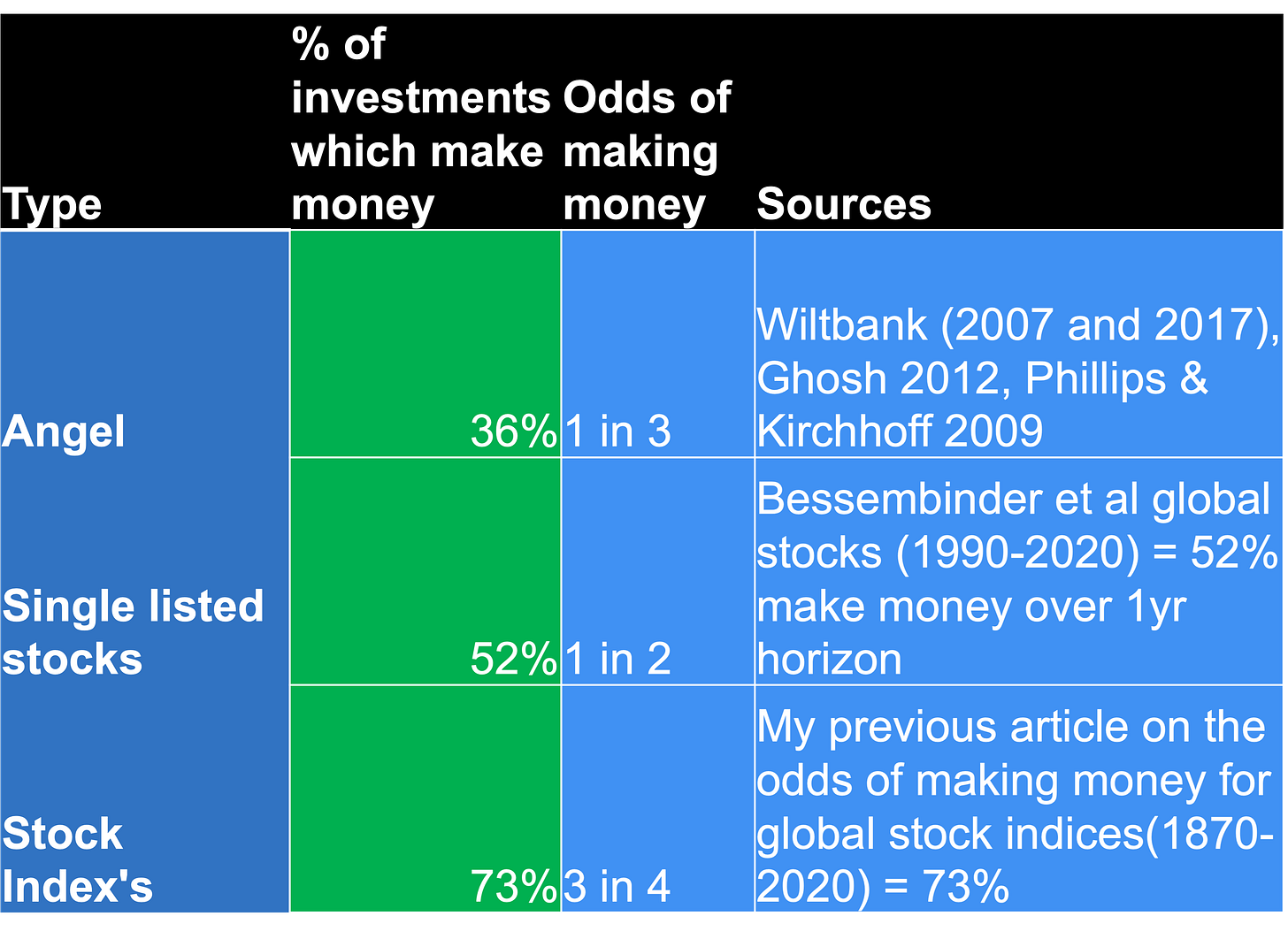

As mentioned in a prior piece on return maxima, Angel Investing sees high failure rates. It’s also an area which is hardest to gather data for, so I’ve looked at multiple studies to produce a simple rough average (the exact number is not so important, the important concept is you have < 50% of making money on any single investment).

So loosely speaking you have a 36% chance or 1 in 3 odds of backing a firm which makes money. Also implies it’s better to be an Angel Investor (back multiple firms/effectively purchase multiple lottery tickets) rather than start your own firm (effectively x1 lottery ticket). Otherwise, the odds are against you making money.

Stock Maths

By the time a company lists its already got a well established product, a lot of employees and the sorts (unless it’s a SPAC in which case you’re buying air). So unlike the Angel Investing studies which were based on success rates over several years (because inevitably they face J Curve returns), I will instead quote the odds of making money over a 1 year horizon for both single stocks and stock indices given they are well established businesses.

So based on Bessembinder et al’s incredible research which looked at 64 thousand companies across 42 countries over 30 years (I know, a lot of data). the result was that 52% of stocks make money over a 1 year horizon. Now traditional financial theory would suggest if you hold for longer, the odds of making money increase. Whilst this is empirically true for stock indices, it does not hold true for single stocks. Over the entire period, only 48% of stocks generated positive returns (4% less than a 1 year holding period).

This was also observed in Bessembinder’s longer period research which focused on 29 thousand US stocks over 98 years, finding similar results that under half (48%) of stocks generated positive returns. So what about stock index’s then?

Stock Index Maths

For this I’ve been able to use my own prior research (see link above): It covered 16 countries stock indices over about 150 years. The answer is 73% or 3 in 4 years, you make positive returns investing in country stock indices. Yet only 2 in 10 people in the UK invest in stocks, whilst 7 in 10 play the lottery. So we’re clearly a nation of risk seekers, just not the type of risks that get regularly rewarded.

Practical Application

So should we just not do Angel Investing and Stock Picking? The above has focused on binary outcomes (making or losing money) and not how much money can be made in each domain. As shown in the return maxima article, you can make a lot more in Angel and Stocking Picking (See Buffet’s or Julian Robertson’s returns for example) than you can in stock index’s, so I think we can sum this up in a couple of sentences:

If you want to make lots of money > do Angel or Single Stock Investing. If you want to make money consistently > buy index’s or mutual funds.

And for those overseeing Portfolio Managers, now you have a benchmark to compare your managers win rates against for picking stocks (52%).

Hope you found this useful

Chris