Intro

Dear Subscribers,

I’m back. One of the core objectives of any financial markets blog, should be to increase your returns over the long term. Otherwise, you may as well read Alice in Wonderland, which is likely more enjoyable. So the first question I want to address after my hiatus is - What’s the max I can make from investing in funds?

In theory returns are a continuous variable, meaning they could be anything from -100% to 1000% annualised and beyond. Though having met 250 + fund managers and easily read 2,000 + factsheets/performance reports whilst being an allocator. Its become clear there is a rough maxima one can hope to make long term (they’ll always be the outliers who do 50% + annualised but they rare). So let’s see what’s possible.

Methodology

Showcase some of the well known, best performing funds over the late 20th and early 21st century (outliers). Then do another section on the best performing fund categories (broad universes). The latter is more useful from an allocators perspective, because you’ve got a higher probability of achieving big returns in such domains.

Best Performing Funds

I’ve complied a short list (thus not definitive) of well known elite funds with track records of 15 years or more (because over 10yrs you could print money just from holding a passive index at times, for example the NASDAQ did 33% annualised between 1990 to 2000). As mentioned in the intro, I’m sure there are funds who have returned more over the long term, though from experience these figures are very high. What you can see is shy of RenTech (arguably the greatest of all time), most sit around 20-30% annualised net of fees.

Interestingly if we go back 5,000 years (because why not?), the first recorded loans weren’t too dissimilar in terms of returns, having rates of around 20-25% (see a History of Interest Rates). So maybe this is the best we can hope for, though let’s look at broad universes next.

Best Performing Fund Indices

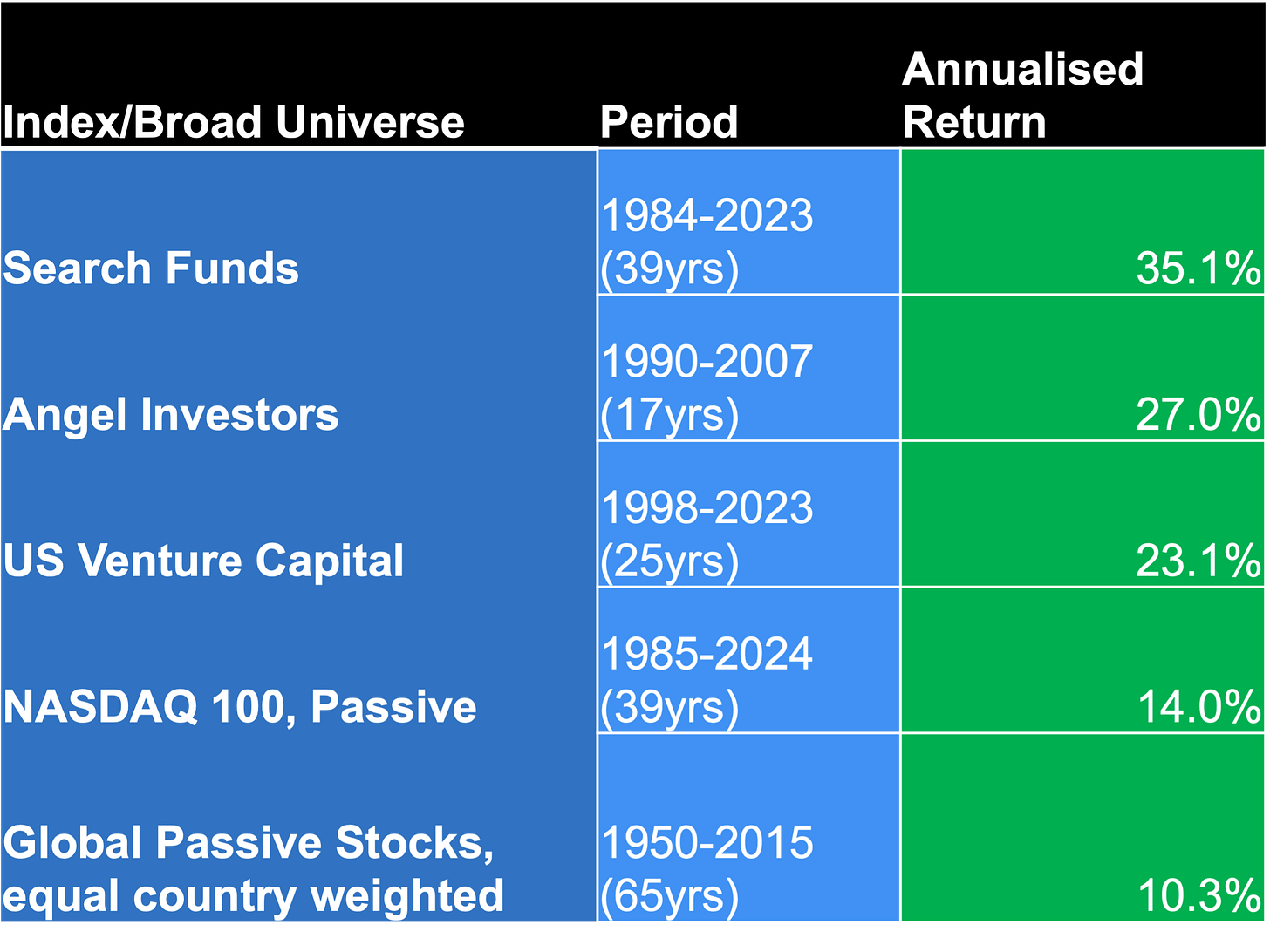

As far as I know, there are no passive indices which deliver 20-30% over the long term. Because if they did, we’d all have bought them by now and the returns would no longer be 20-30% (competition drives markets, more on this below). However there are some active indices which deliver around 20-30% annualised, all operating in the illiquid’s space. Here are quick definitions for those unfamiliar:

Angel Investing - $25-100K stakes to seed companies (based off Jason Calacanis’s Angel Book)

Venture Capital - Average fund size $155m, invest into early stage companies (typically later than the Angel’s)

Search Funds - Median fund size/acquired company $14 million. Entrepreneur raises a few million dollars > then buys a single firm and uses their skills to grow it.(apologies for using averages and then a median straight after, the point is we can agree these funds are small).

On the topic of competition then, you may notice that all 3 investment strategies mentioned are seriously capacity constrained/a lot smaller than mutual funds and ETF’s. Thus they are picking up Size and Illiquidity Premium’s to the nth degree.

Despite the high returns however, these things are all ultra high risk. For example for the Cambridge Associates Index worst drawdown was -72.6% (see Investing Amid Expected Low Returns). And as for Angel Investing? 70% of startups backed lose money. So in short:

Small fund size + illiquid for several years + massive prospective losses = Low competition and thus high returns

Practical Application

So as a rough rule of thumb, 20-30% annualised is the best one can hope for long term, by investing into funds (yes the gross returns are higher, though you’re always going to be hit with heavy fees for performance like this).

I appreciate most of this stuff is ultra high risk, though in my view risk is predominately driven by position sizing. Because if you put 1% of your wealth/AUM into these sorts of investments and it goes to zero, big deal. If it does 10X however (which is 27% annualised over 10 years), that will add a nice bit extra to your overall returns (for the record I live by my words on this blog, and have about 1% of my wealth in crypto and 1% in Venture Capital).

Hope you found this useful

Chris