Intro

Following on from my last article about what it takes to be a Champions League Fund Manager (see link above), let’s take a look at one of the most talked about fund manager’s on the planet - Cathie Wood. I’ve heard a lot people give opinions on her fund, though little evidence (hence me writing this article).

Before I begin, let me state that regardless of performance, Cathie has built a business from scratch that went up to $60bn AUM, being cited as one of the Top 25 most influential women globally by the FT. That’s phenomenal. So now I have made it plain this is not a hit piece and instead an objective review on a quiet Sunday, let’s begin.

Methodology

Take the performance of her flagship fund ARK Innovation since inception to present day (referred to as ARK throughout) and compare it to a passive S&P 500 tracker. As this is the benchmark used in the ARK factsheet and the fund mostly holds U.S Large Cap. Data from TradingView

Work out Beta, Annualised Performance etc.

Highlight key stats to provide an insight on. There’s 9 years of data, so comfortable drawing conclusions.

Performance Table

Insight 1: Higher Beta doesn’t mean Higher Returns

If you take Beta literally, what this means is the higher the Beta ➡️ the higher the expected return and volatility (the classic risk/reward trade off). However what you can see is despite ARK having a higher Beta and volatility, it doesn’t have a higher return. Why?

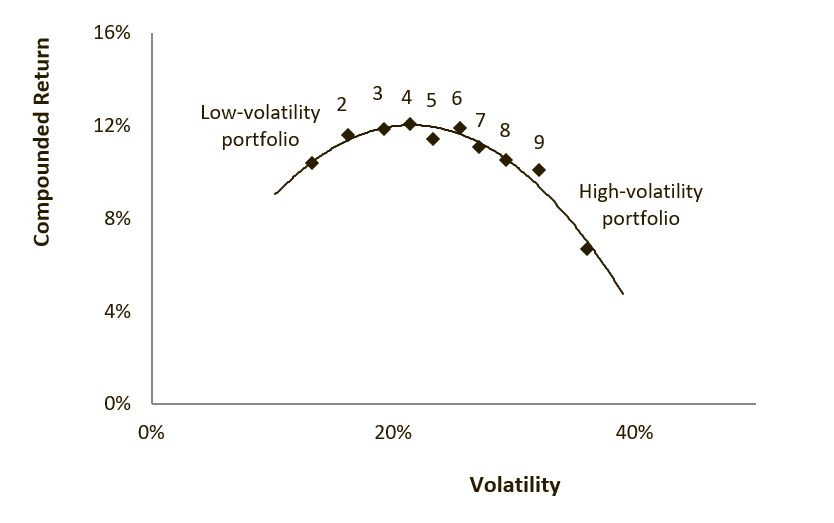

Introducing my favourite Factor, Bet Against Beta. A few decades ago, researchers started to realise that low beta assets, actually performance better than high beta assets. If you don’t believe me, here’s a pretty good research paper from the Team at AQR, showing it’s prevalent in a lot of different markets.

100%+ returns in a year do look super attractive and make headlines, as achieved by ARK in 2020 (see above Best Year). However long term you will not be better off, as evidenced by the annualised return being lower than the S&P tracker. This can be a hard one to get your head round, so here’s a rough visual indication of the Bet against Beta concept.

Insight 2: It’s hard to beat the S&P 500

When you’ve got passives charging as low as 0.03% (see above table), it’s incredibly hard to beat them when you’ve got to pay for analysts, your yacht etc. If we use rough maths, then if ARK charged the same as the Vanguard Tracker, it would deliver slightly higher annualised returns than the passive by 22 basis points.

8.7% + (0.75% - 0.03%) = 9.42% annualised return

Moreover, beating the S&P 500 is one of the hardest things to do (shy of wrestling a half ton Black Bear). Based on evidence over the same period ARK has been running, 91% of funds didn’t beat it. Convert this into odds, and you realise Cathie Wood faces a 1 in 11 chance of beating the index. Even with the 4 decades plus experience she has, this is a tough job.

Recommendation to Investors

1. This is a great fund for making leveraged bets

Say you have high conviction in which way the S&P will go over the short term. Then using this fund to express that view (both long/short), is a great way of making serious PnL. It’s a several billion dollar fund and trades all day because it’s an ETF, so liquidity should be pretty good to slam trades in and out of.

If instead you’re looking for a long term buy and hold U.S Equities Fund, the evidence (both ARK’s performance and the 1 in 11 odds of beating the S&P 500) suggest you’d likely be better off buying a passive tracker.

2. Don’t take excessive risk, you won’t be rewarded

The old age saying of “no risk, no reward” does still apply, however it’s not linear as evidenced above and neither is downside risk (see below chart). If you have a higher beta or volatility than the market, you’re unlikely to do much better. Instead, seek better risk adjusted returns, rather than outright returns. This is evidently what Millennium has done, who have delivered a Sharpe ratio more than 10X that of ARK (see previous article).

We all want 100%+ returns and to be on the front cover of Forbes magazine like Bruno Mars. However if you want to make serious money long term, buying and holding volatile stocks is unlikely to work. Instead, take time to develop an edge, even if it takes 10 thousand hours. If you don’t want to do this, then passive trackers are probably the best approach.

Conclusion

Is Cathie Wood worth more than you and me? Yes. Does she have more followers than you and me? Yes. Does her fund beat a passive tracker and deliver a better risk adjusted return? No. And that is what I wanted to find out in this research. Go beyond the headlines, and review the evidence.

Hope you found this useful, and if you are Cathie Wood I am happy to present in person, I am not a keyboard warrior

Chris