UK Property Prices: The Runaway Train

Disclaimer: This is not financial advice or the views of my employer, just weekend research outside of work.

Intro

Last month, I published an article on how UK Interest Rates (IR) affect UK asset class returns. They clearly affected stocks and bonds, however UK property prices seem to roar on regardless of which way IR went. Hence the title "The Runaway Train".

Now I promised a follow up to this because as Antti Ilmanen pointed out in Investing Amid Low Expected Returns, there were potentially flaws with the dataset. So I have combined it with ONS data this time round, which should be the holy grail (if you trust the government that is).

So do the datasets paint the same picture, that higher IR do little to affect UK House Prices from rising? Well...

There are differences, though the picture remains the same. UK house prices continue to go ⬆️ (as shown by all values being >50%), regardless of which way IR go. The other good news is the correlation between the datasets is 0.73. So I'm fairly comfortable with Macro History's reliability.

So the UK Property train doesn't seem to stop. Can we explain this? Here's 3 simple factors, which I think might help.

Factor 1: Most people don't use mortgages

The general theory is:

IR ⬆️ > Mortgage Rates ⬆️ > demand for houses ⬇️ > house prices ⬇️

However in the UK almost 6/10 active participants (see note below) in the housing market don't use mortgages. As you can see, this is a trend that's only increased in recent years.

And if we look at the 4/10 who do use mortgages, 3/4 are on fixed IR's. So when IR ⬆️, only 10% of homeowners are immediately affected. It's no wonder that people says it takes a while, for IR changes to affect the economy.

Note: By active participants I mean homeowners and not first time buyers, because they are not actively participating in the housing market. They are in the queue outside the nightclub, not inside yet.

Factor 2: We don't have enough houses

Many people say this in the pub and on the news. If there is a lack of supply, that would help explain why prices keep going higher. However I'm yet to hear anyone put a number on it. So let's have a crack, using data from the 21st century onwards;

Add the number of houses built from 2000 to 2020 (latest year in dataset) = 3.73 million

Minus the number of empty homes (see note below) = 0.48 million

Minus the growth in population over the same period = 8.4 million

Divide the growth in population by the average number of people per household = 2.4

Realise we need to visit B&Q

To put this into a word equation:

(No. Houses built - empty houses) - (growth in population / average people per household) = housing shortfall

To put this into a number equation:

(3.73 - 0.48) - (8.4 / 2.4) = -0.25

To give you the clear answer rounded to the nearest 10 thousand:

Estimated Housing Shortfall = 250 thousand

Note: There will always be empty homes, due to

a) Structural changes, creating a mismatch between where jobs and houses are

b) Second homes (such as holiday homes), of which there's quite a few

c) Overseas investors purchasing property here, though leaving them vacant. Perhaps they too realised, that UK property prices seem to go up regardless of IR.

Factor 3: Inflation

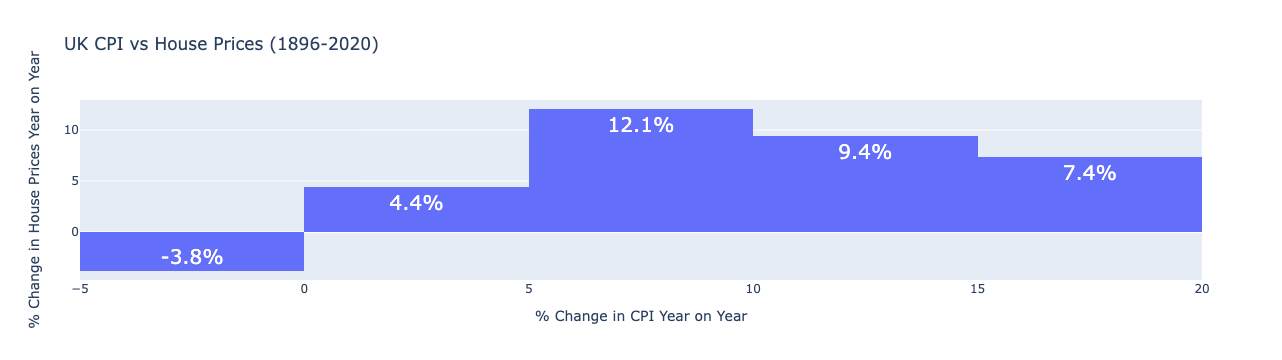

If it costs me £1 to buy a hamburger, I will sell it for £2. If it now costs me £1.50, I'm probably going to sell it for £2.50. Turns out the same is probably true in housing. If the cost of building a house goes ⬆️, it's highly likely house prices will go up too. This can be seen in the chart below.

To explain this visual:

We've put year on year inflation (CPI) into 5 different buckets (When CPI is between -5 to 0%, 0-5%, 5-10%, 10-15% and 15-20%)

Then taken the average % change in house prices at the same time, of all the observations in that bucket.

You can clearly see when inflation is low, house prices tend to not go up much. Whereas when inflation is high, house prices tend to go up more. Now some of you will be saying;

"Why isn't this linear Chris? Surely if inflation goes up 15% house prices should go up 15% too?"

Unfortunately perfectly linear (1:1 relationships) do not often exist in the real world (though obviously the larger the car, the harder it is to park). You get the idea though, inflation ⬆️ house prices ⬆️.

Expressing an investment view

So I've painted a pretty bullish view on UK housing. How to express an investment view then? (as always not financial advice, just keeping it practical) Well you could speak to my good friend Hicham Alaoui at Nest Seekers, to source you a great property. However that might take time. So what if you wanted to express a view tomorrow? Well, how about UK Real Estate Investment Trusts (REIT's)?

For those unaware, these are listed companies (just like stocks) which essentially buy a range of real estate assets (houses, commercial property etc), then give the majority of rental income to shareholders. So owning shares in a REIT, is basically like owning multiple houses and renting them out. So using REIT's to express a view on UK housing, should work right? The data says otherwise.

To explain the above visual of correlations:

FTSE NAREIT UK = An index of UK REIT's

ONS House Price Index = the government dataset I used in the intro

FTSE Small Cap ex. Investment Trusts = UK small companies index, not including investment trusts (as you'd end up with some REIT's, thus increasing the correlation unjustly)

As you can see, the correlation between UK REIT's and UK House Prices is woeful (0.04). However UK REIT's actually correlate a lot closer to Small Cap Stocks (0.64). If you're wondering why, just have a look at the REIT's which make up the index. You'll see the average REIT is £1.2bn, which is firmly in the Small Cap size bucket.

So if you want to express a bullish view on UK housing, buying a house seems to be the only way (though given that every house is unique and its beta unknown, you could easily not realise the gains of the index). Thus, maybe we should just take Xi Jinping's stance on housing which is "houses are for living in, not for speculation".

Conclusion

I think there's 2 important conclusions we can draw which are against the consensus, hence the importance of this research:

UK interest rates ⬆️, does not push UK property prices ⬇️. This is due to multiple factors, though 3 clear ones are A) most people don't use mortgages B) there's not enough houses C) higher inflation leads to higher prices

REIT's are not a good way to express an investment view on UK house prices. They're more so a bet on small cap stocks.

Thanks for reading, and know that my heart goes out to first time buyers. Everyone, should have a place to call home.

Chris