UK Interest Rates and their effect on different Asset Classes: 150 Year Case Study

Disclaimer: This is not financial advice or the views of my employer, just a fun weekend research project outside of work.

Intro

Now if you're not familiar with my writing, I try and make content as accessible as possible. So for those with PhD's or 8000 years experience in markets, you'll probably find things quite simplistic. Though I hope you come away having learnt something new too.

I'm going to approach this one asset class at a time, then give investment recommendations at the end. Again this is not financial advice nor do I encourage you to act upon this article, I'm just doing this to keep it practical. After all, the whole point of investment research should be to improve returns (unless you enjoy scatter plots more than snowboarding).

Approach

1) Get a big data set (150 years) on UK interest rates and UK asset class returns year on year (YoY). If you're interested in the exact asset's tracked click here to access the documentation.

2) Split the dataset in 2: All observations when IR went up YoY, and all observations when IR went down or unchanged YoY.

3) Create some simple tables and charts.

4) Give a brief summary of findings.

Equities

Let's take a look at the UK stock market. What do we find?

The results were fairly clear - Stocks prefer IR ⬇️. When IR's are rising it's a 50/50 shootout whether stocks go up at the same time YoY (see % stocks goes up row), and when IR's are falling stocks go up 7/10 times. This fits in with Ray Dalio's rough saying of 'when IR are high, assets prices are cheap and vice versa'.

The Average Return & Volatility (1 Standard Deviation for those interested) is also worth highlighting. As you're getting much better compensated for the risk taken when buying stocks, when IR ⬇️ (your average return goes from 1% to 10%, more than compensating for the increased volatility from 14% to 21%).

Bonds

Let's take a look at long term bonds (the data is a composite of consols, 15 and 20yr UK govies for those interested).

Bond Yields tend to follow the direction of IR - 2/3rds of the time when IR ⬆️, and 7/10 times when IR ⬇️ (100% - 29% = 71% aka 7/10). Thus we can get a higher yield/income and a higher return, when IR ⬆️ right? Wait a second...

Similar to Equities, we find IR ⬇️ returns ⬆️. Why? For those unfamiliar with bond mechanics, this is because there is an inverse relationship between the price of a bond and its yield (see chart below).

Again similar to Equities, you're getting much better compensated for the risk taken when buying bonds if IR ⬇️.

Real Estate

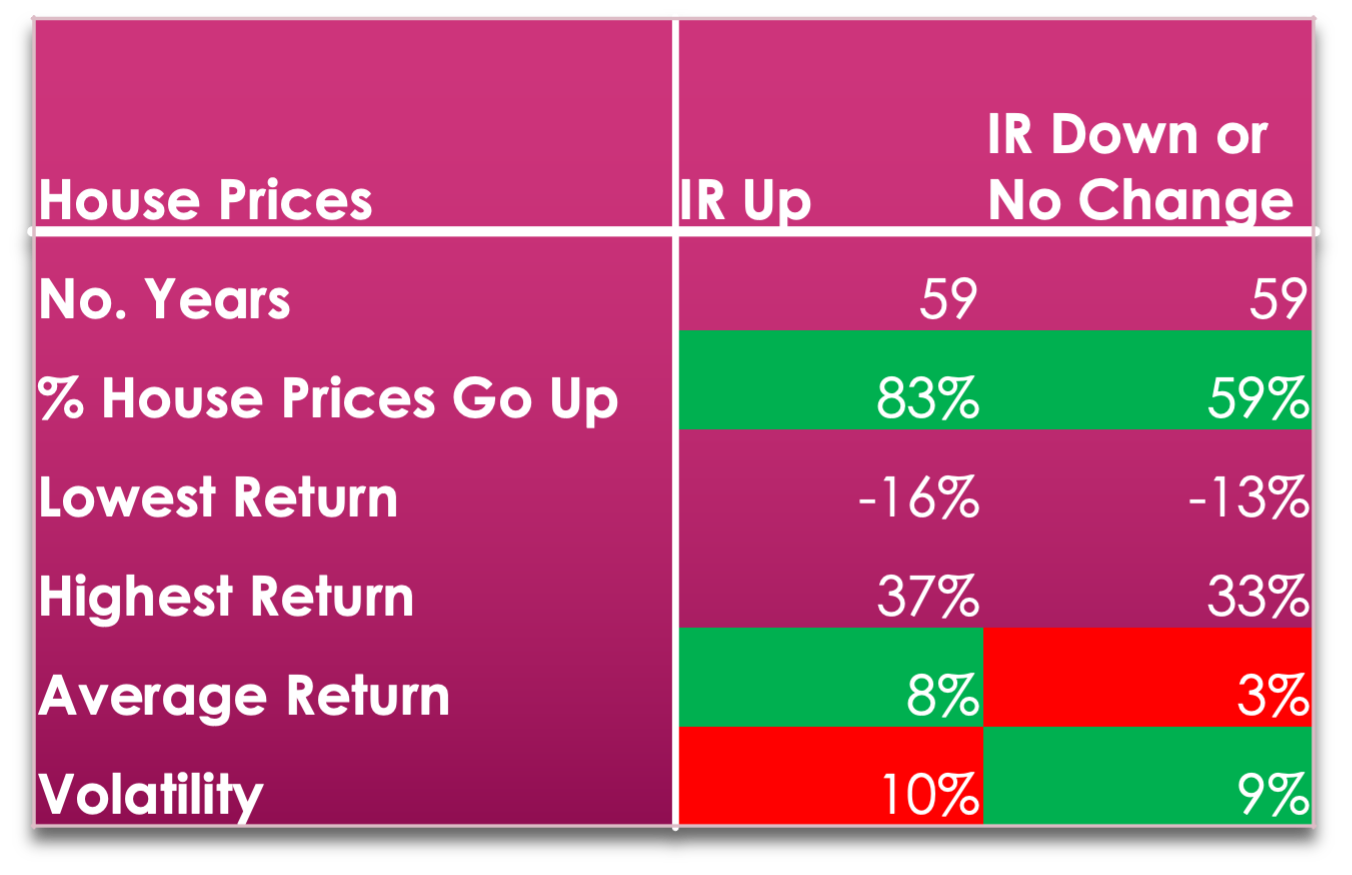

This one surprised me, so I will do a follow up article on UK Property Prices in the coming months (about 1/3rd of the UK population's wealth is in Property, so this is quite important). The dataset is also a touch smaller, though still over a century's worth (118 years).

What effect do IR's have on UK Property Prices? Urhhh, not much (based on this dataset, see note below) They're a touch more volatile when IR ⬆️ (you can see the lowest and highest return increases, as well as the volatility).

So contrary to the doom and gloom being painted across the UK property market right now (March 2023), I'm not that bearish on UK property prices.

Sure they might go down a bit, given that the lowest return on record (-16% in 1929) happened went IR ⬆️. Though I think you'd agree - today's issues are not as bad as the issues in 1929 (although I lack first hand experience of them).

Note: Housing data can vary dramatically, so I will be looking at ONS data in my next article to see if the findings are similar. Also Antti Ilmanen in his book "Investing Amid Low Expected Returns" has highlighted potential issues with the housing data from this dataset, so please don't go and buy a house tomorrow based solely on this article.

Foreign Exchange

We're just looking at the value of the pound against the dollar (GBP/USD or cable for those familiar with FX slang). This is because USD is the reserve currency of the world, thus the most important. I've also removed all observations from the dataset where the value of GBP was fixed or pegged, as both prevented market forces/fundamentals from affecting it (*Enter George Soros).

Contrary to popular belief that as IR ⬆️ "hot money" flows into a country, pushing the currency's value ⬆️ this is not what we find (on a YoY basis anyway).

The 1st reason is because FX rates are determined more so by relative IR moves (aka IR differentials), rather than the outright level. Meaning if U.S IR ⬆️ by a similar amount to UK IR, then there's no advantage to hot money flowing into the UK. And as you can see from the chart below, we basically do whatever the Americans do.

The 2nd reason is because the value of GBP has fallen gradually over time (see chart below). If we add back the entire data set to give us a 150 year picture, we can see a clear story - trips to Las Vegas, have consistently gotten more expensive for UK residents. Why? It's basically the decline of Britain as a world power. Would recommend reading Ray Dalio's Principles for Dealing with the Changing World Order, if you're interested in this.

Investment Recommendations

Do UK IR's destroy UK asset returns? Could argue either way. Here's my take;

Equities = When IR ⬆️, you probably want to reduce your allocation to stocks. This is because a) the probability of you making money falls b) the average return falls. The opposite is true if IR ⬇️.

Bonds = For long term bonds (as short term bonds will behave differently, again bond mechanics), try not to jump into them too early during an IR hiking cycle. As you're not being well compensated for the risk taken (see average return and volatility rows).

Real Estate = In the UK, it seems like we have a structural bull market/train that cannot be stopped. So getting on the property ladder does seem sensible. Though in my next article on UK property, I will give better advice on how to express an investment view here.

FX = If you're playing the long game (not trying to day trade, instead trying to build wealth over a lifetime), I think holding some USD assets and not just UK assets is sensible. I do not see this trend reversing, and I'm yet to meet any fund manager or FX trader who is bullish on GBP long term.

Hope you found this article useful and learnt something new. I'm going to be doing a lot more research this year, so please stay tuned.