The case for Dynamic Asset Allocation: Beating the market whilst taking less risk

Sounds like the sort of thing only Gandalf could pull off

Introduction

You probably think this is clickbait. It's not. I don't think I've "cracked" the market by any means, more just demonstrated that simple systems are often far more effective than we think. To give you an idea of where I'm going with this, you've probably heard that Asset Allocation is a large driver of investment returns (see page 4 of this pdf).

So with that in mind, let me introduce to a simple system I've developed through trial and error (basically Tactical Beta), which produces larger returns and takes less risk, than being 100% invested in stocks. To prove this is not some PhD Model, which only a handful can implement. Let me demonstrate the model's simplicity through a fictional story, showing that anyone can do this.

Riley's Top 3

Meet Riley, an American actress living in California (as I said, totally fictional). She's in her 20's and wants to invest for her retirement, though;

a) Has no knowledge of investments, with as much expertise as the Pandas in Edinburgh Zoo

b) Has limited time, because she's an actress and spends most of her free time rollerblading like Barbie (going by the trailer, haven’t seen the film)

So what does she do?

Introducing The Top 3 Asset Allocation System

Every year around Christmas and New Year, when nothing much is happening (unless you're trading the South African Rand), Riley takes a few hours away from Christmas movies and Lindt chocolate boxes, to review her portfolio.

She can only invest in 5 things (I've provided links to example products for each, to show how easy and realistic the system is):

Stocks = S&P 500 (link)

Bonds = U.S Aggregate Bond Fund (link)

Cash = Short Term Treasuries (link)

Real Estate = U.S REIT Index (link)

Commodities = GSCI Index (link)

All she does, is pick the 3 she thinks will perform best the following year, and weights them equally (so 33% in each of her 3 choices). Makes her investments, leaves them the whole year. Then repeats the system next Christmas.

So for example, Riley has chosen Stocks, Bonds and Real Estate as her top 3 performers. She has $100, so puts $33 into Stocks, $33 in Bonds, and $33 into Real Estate. Then leaves them invested until the following year, when she picks her new top 3 (which may well be the same).

Pretty simple system right?

Once a year, pick the 3 out of 5 asset classes you think will perform best the following year. Invest and leave them for a year, then repeat.

So if you consistently pick the top 3/5 asset classes every year, how much do you make?

Performance

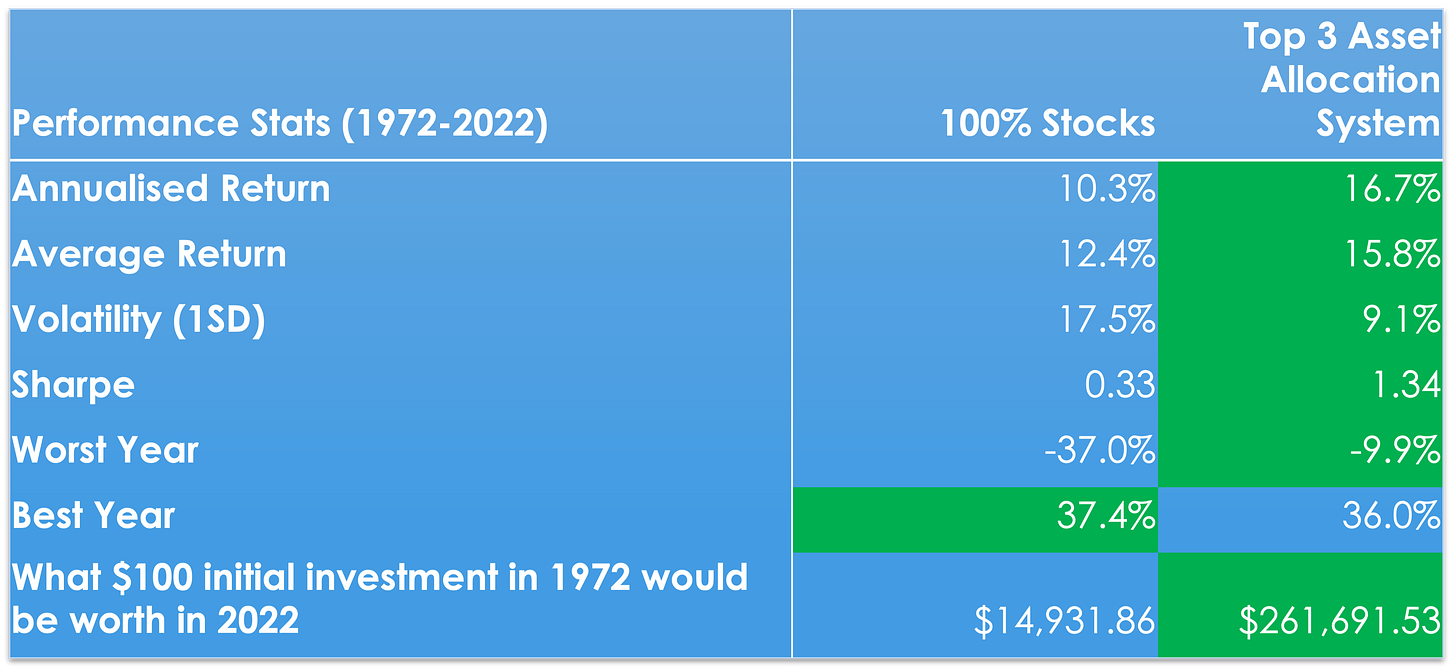

I've got data back as far as I can go from here, which I have cross referenced and happy with its reliability. It covers 1972-2022 (half a century). We need a benchmark to compare it to, so we'll use the traditional 100% stocks portfolio (S&P 500). I've added some further analysis below the table.

1. It wins on every stat, albeit one

If you can consistently pick the top 3/5 asset classes every year, you're going to destroy stock investors. I appreciate this might be challenging in practice and some years, you might only get 2/3 right (you are guaranteed 1/3 though). However surely it's worth a crack at being Multi-Asset, given how outrageous the final monetary value is compared to 100% stocks, over a typical investors lifetime? (see bottom row of performance table).

2. Better Performance, Lower Risk

Your annualised and average returns are way higher, and you're taking far less risk. For those not familiar, Sharpe ratio's are a simple way of measuring an investor’s risk to reward. And you can see that the Top 3 System delivers 4X higher risk adjusted returns (see Sharpe row).

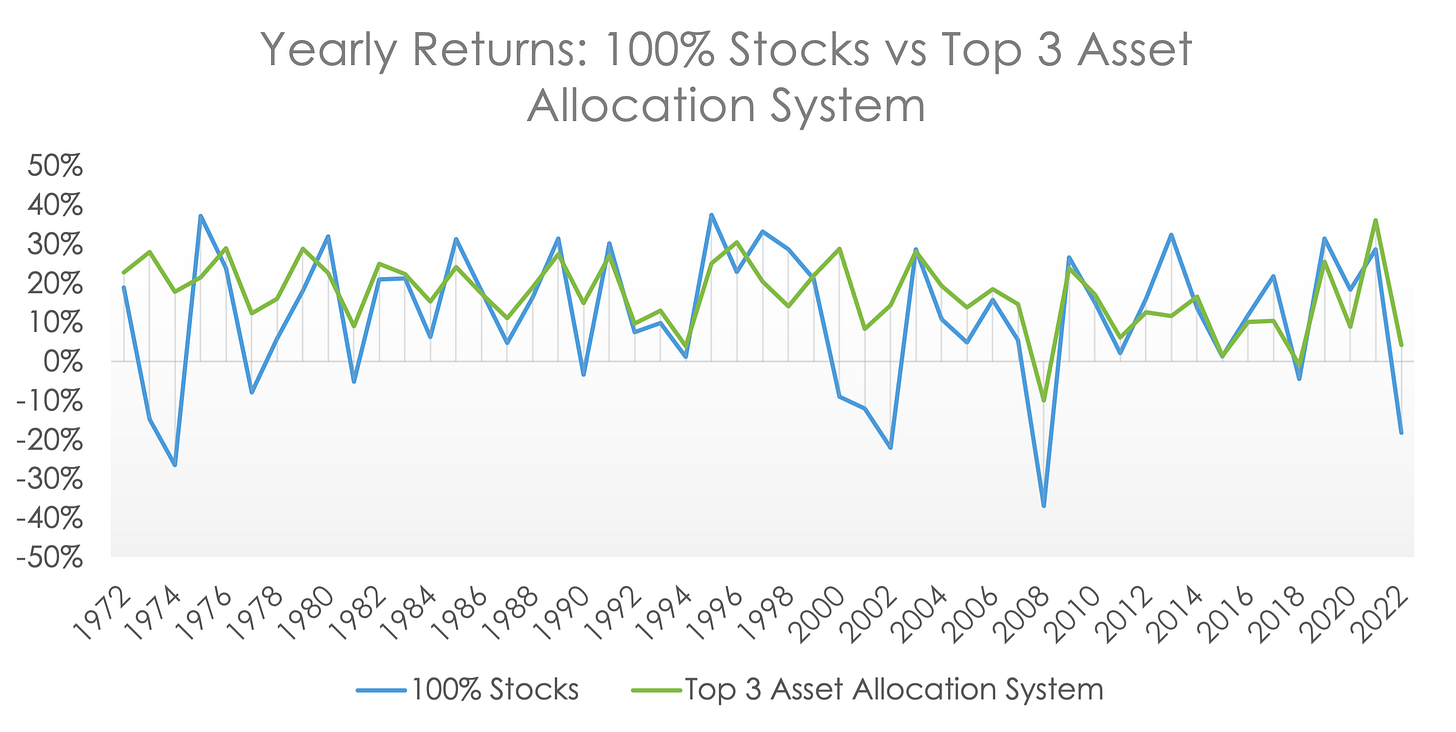

Below is the yearly performance overtime. As you can see over half a century, it only had 2 negative years, whereas 100% stocks had 11 negative years.

Investment Recommendations

Am I saying we should abandon the complex Convertible Arbitrage or Global Macro Strategies, which trade commodities like a James Bond Villain? I'm not. They have their place, I'm just pointing out that you don't need to develop really complex systems to beat the market, both in absolute returns and risk adjusted returns. Get the big picture right (Asset Allocation), and you are going to make money.

In terms of being practical about this, I would firstly recommend always having in the back of your mind "what are your top 3?". Because if you get these right and combine it with your edge in certain areas (e.g. identifying great value stocks, attractive parts of the yield curve), then you've got a really good chance of beating the market.

Secondly, maybe try backtesting this system on indices specific to your country of origin (e.g. if living in the UK, change the S&P 500 to FTSE 100, and U.S REIT index to UK REIT index etc), or doing a global one. Because maybe the U.S is a unique case, though unfortunately I lack the Bloomberg Terminal to investigate this further (GoFundMe coming soon).

Thanks as always for reading, hope you found it useful

Chris