Intro

The main idea behind passive investing is that markets are pretty efficient, otherwise you’d be better off going active. However, what most people haven’t recognised yet is that the more people that go passive > the more inefficient markets become (see Sammon and Shim, 2025 for example).

To illustrate my point, I’ll show you how you can easily beat a really popular index known as the Bloomberg Global Aggregate, through increasing your YTM without taking on extra credit or duration risk.

Index Composition

As a proxy of what the index contains, let’s take the current holdings of a popular ETF which tracks it by State Street (ticker: GLAD, I’ve looked at BlackRock’s etc too they all have similar holdings). Here’s a quick summary of what GLAD contains (as of 26th May, now you know how I spent my Bank Holiday):

Treasuries/Government Bonds (55%)

4 Biggest country exposures: USA 40%, Japan 10%, China 10%, France 5%

For those wondering how Japan and China ended up with such chunky weightings it’s quite simple - the more debt a country has relative to others > the greater its weight in the index. And so the more people/money that track the index > the lower the YTM’s become for big index constituents, because you have a structural bid for that country, regardless of how much debt it has.

Sure, there are index’s that get round this inherent issue (e.g. capping weights at 10% max per country), but The Bloomberg Global Agg is often a default choice alongside the MSCI World when it comes to passives, so there’s easily over $100bn tracking this and similar bond indices.

So with that in mind, I came up with a revolutionary strategy…

Swap the low yielders for higher yielders

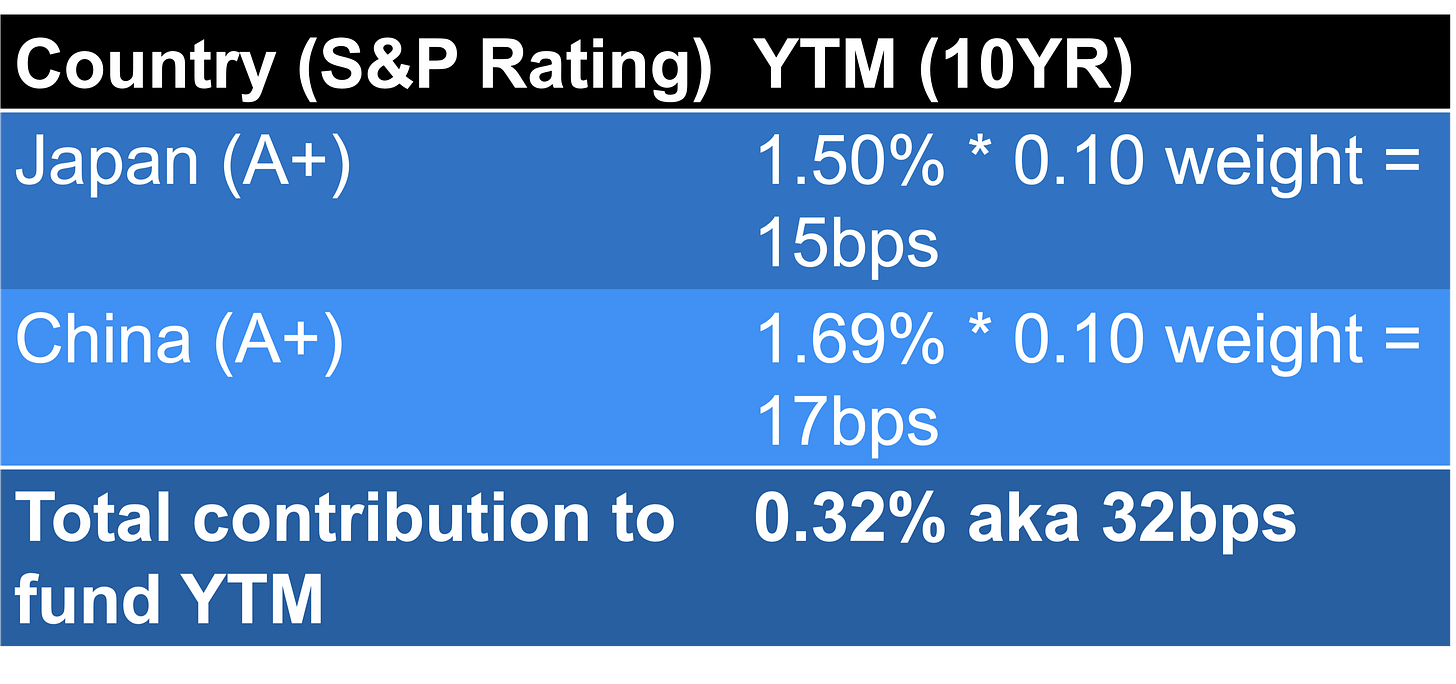

Japan has had very low yields for over 2 decades and China has also entered that realm, now trading at a negative spread to US Treasuries (see chart below, showing China 10YR minus US 10YR Yield). Both China and Japan are A+ on S&P’s Credit Rating Scale, so we’re simply going to find some countries to replace them with that have higher yields.

Rather than do a simple 2 country swap, I am going to be better and use 4. Why? Because Japan + China weights in the index = 20% total, and I would rather add only 5% weight to any one country. That way I have no more than 10% exposure to any one country apart from the USA (recall France is the 4th biggest index constituent with 5% exposure, that’s why I know my rule will hold up because 20% / 4 countries = 5% additional weight each). If that doesn’t make any sense, just look at the 2 tables below and it will.

For simplicity, we’ll presume we’re swapping 10yr bonds (although this trick works across most of the curve). So (Japan Yield * weight) + (China Yield * weight) = total contribution to portfolio YTM, as you can see in the table below:

And we replace these with the following countries:

For the record, I chose these x4 countries pretty much at random using data from TradingView and here (so you can definitely beat the total YTM quoted above). If you really wanted to max out YTM you’d buy Iceland (A+ rating/same as Japan and China, though yielding 6.77%), however they only have about $20bn of government debt so not practically implementable for a big fund manager due to liquidity.

So Iceland aside, what I’ve demonstrated is you can easily increase your YTM by 50bps (0.82% - 0.32%) without taking any additional duration or credit risk (in fact, we’ve actually lowered our credit risk if you believe the ratings, given all of these countries are above A+).

Practical Application

Do explore index’s weightings, because this trick works far beyond the Bloomberg Global Aggregate (e.g. it would work on the JP Morgan Global Government Bonds index too). For institutional fund managers, I hope your tracking error constraints allow you to pull this off (I know how ridiculously tight they can be) and for retail investors, simply look to reduce your weight to an aggregate bond tracker and re-allocate that capital to a country specific etf, like IGLT which tracks UK government bonds.

Hope you found this useful

Chris

https://substack.com/@egretlane/note/p-164695987?r=5ezmlv&utm_medium=ios&utm_source=notes-share-action